Opening Up 5G

There’s a big new idea in mobile networks: Openness How should manufacturers, network operators and governments respond?

Alan Carr: Director, Mobius Consultants Limited

A new idea is sweeping through the mobile network industry – a shift from the present situation where mobile networks are a monolithic whole purchased from one supplier to a position where modular components, open interfaces, software-defined functionality, open software, and cloud native design are the norm. The intention is to increase competition, reduce reliance on a single supplier, cut costs and improve flexibility. There are many claims and counter claims about the merits of the approach. Deciding where, when and how to apply openness requires careful and nuanced analysis.

Setting the scene

Mobile networks have traditionally been hardware intensive with liberal amounts of specialised computing, switching and radio technology. More recently, there has been a move to transition some of the functionality into software; but attempts to introduce more competition by opening up the network have mostly failed, especially in the radio access part of the network, the RAN.

The OpenRAN concept is an alternative in which the RAN consists of standard components connected with open interfaces. Functionality is mostly in the form of software preferably implemented in the cloud and using an open source model. In addition, the system should have built-in intelligence to automate many of the tasks involved in operating the network.

The Japanese operator Rakuten has pioneered the OpenRAN concept and claims substantial cost savings and other benefits. The idea has also found favour with governments looking to ban equipment from Huawei, and sometimes other Chinese manufacturers, in their national networks owning to security concerns.

There are many claims and counter claims and deciding on the best way to proceed requires a complex and multifaceted analysis. This is the subject addressed in this paper.

The Status Quo

Mobile networks are an increasingly important part of national infrastructure. Cisco estimated in 2018 that traffic levels were growing at 47% per year and this is likely to have accelerated as a result of the Covid-19 crisis. All such networks consist of two components – a Core Network responsible for connectivity to other networks and for overall control and management, plus a Radio Access Network (RAN) responsible for connectivity to mobile devices. In both cases, these network components are normally a monolithic whole provided by a single supplier.

Around 70% of the cost of a mobile network is in the RAN so a more competitive and open market would be attractive to operators. Such as approach is also attractive to governments wanting to control who is supplying the equipment used in their national networks.

Another issue is that mobile networks are becoming increasing complex to operate. This applies especially to 5G where there are many choices and controls both in network build-out and during operation; these are needed to optimise performance in the light of changing traffic patterns. This calls for a level of automatic control typically not available in monolithic single supplier networks.

Opening up the RAN

The solution to the issues listed above is to shift from the traditional telecommunication model involving specialised hardware and a single supplier, to an IT centric model involving open standards, a software focus and, increasingly, cloud-based solutions. This is becoming possible as a consequence of the ever increasing performance and reducing cost of IT hardware.

The solution to the issues listed above is to shift from the traditional telecommunication model involving specialised hardware and a single supplier, to an IT centric model involving open standards, a software focus and, increasingly, cloud-based solutions. This is becoming possible as a consequence of the ever increasing performance and reducing cost of IT hardware.

After years of rivalry, the 3GPP organisation is now the unchallenged source of mobile industry specifications ranging from the first digital 2G standard right through to the most recent 5G system. But 3GGP is not involved in how networks are implemented; this has been left to manufacturers such as Ericsson, Nokia and Huawei. Now organisations such as the O-RAN Alliance, the Telecom Infrastructure Project and the Open RAN Policy Coalition are defining how the RAN, and in some cases the Core Network, should be built in an open manner.

The O-RAN Alliance is leading the transition and seeks to introduce a combination of openness and intelligence into networks and to do this with a combination of artificial intelligence, virtualisation, interoperability, open interfaces, whitebox hardware and open source software.

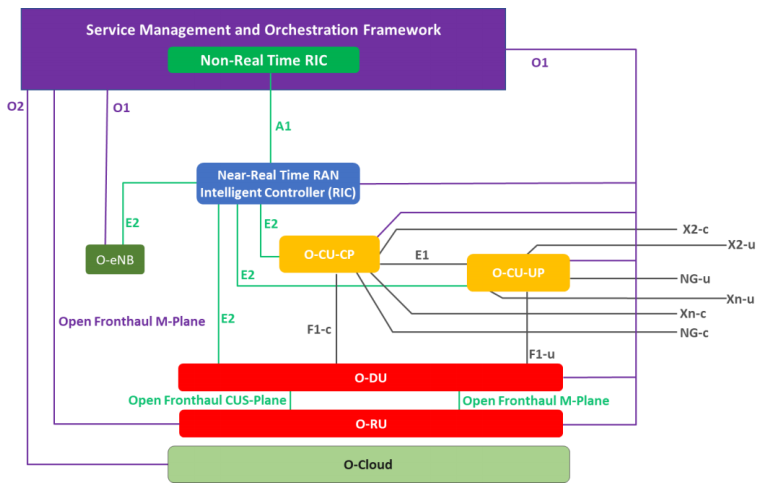

The diagram above shows the O-RAN alliance reference RAN architecture. Key features are:

- Multiple open interfaces between different components

- A controller using artificial intelligence for automatic network control and operations

- Definition of components depending on the level of real-time operation required

- At the bottom of the diagram, the use of cloud technology as familiar in the IT industry.

A Japanese Pioneer

The highest profile pioneer of open mobile networks is Rakuten, a well-established e-commerce company in Japan. Recently Rakuten took the bold decision to enter the Japanese mobile market with a fully open and virtualised mobile network. The initiative is led by a charismatic duo who met by chance at the Mobile World Congress: Rakuten’s founder and CEO, Mr Hiroshi Mikitani and his CTO, Tareq Amin who is now perhaps the leading advocate of open networks.

Rakuten launched a fully virtualised and open 4G network in April 2020 and followed this by launching 5G, at no additional cost to subscribers, in September 2020. A full standalone launch of 5G is scheduled for Q2 2021. At around 2.2 million subscribers, Rakuten is relatively small, but its pricing model substantially undercuts the three incumbent Japanese operators and rapid growth is likely. Key partners in the initiative are Tech Mahindra and the Japanese equipment manufacturer NEC.

Rakuten claim that by adopting an open network approach, they have reduced capital costs by 30% and operational costs by 40% and report it is much easier and faster to introduce new applications in response to customer requirements. In addition to an open RAN, Rakuten, in conjunction with NEC, has developed a virtualised core network which, in the absence of an alternative, is claimed as to be a defacto standard. The result is the world’s first fully virtualised, open and cloud native network called the Rakuten Communication Platform (RCP).

In addition to implementing RCP in its own network in Japan, Rakuten has set up a global sales and marketing operation in Singapore and is offering their solution to other network operators worldwide. This is analogous to Amazon in 2006 who offered its in-house cloud based system to customers worldwide, leading to the highly successful Amazon Web Services (AWS) cloud platform. Rakuten will no doubt be hoping they can achieve similar success with RCP.

Other Developments

Network operators worldwide have committed to the Open RAN approach. Traditional telecommunication manufactures like Ericsson and Nokia have started to produce open RAN components. And there are several new entrants such as Mavenair who see a market discontinuity enabling them to enter the normally very exclusive telecommunications market. Large IT companies like Cisco and even Facebook also sense an opportunity to establish a presence.

Several governments are also enthusiastic about the idea of open mobile networks, the main reason being to support policies of excluding Huawei and other Chinese vendors on security grounds. For example, in November 2020 the UK Government committed £250m to a 5G supply chain diversification strategy. The policy favours the Open RAN approach and seeks to encourage new suppliers. NEC of Japan is seen as particularly well positioned and has announced a new Global RAN Center in the UK. The UK Government and NEC have also recently announced the launch of the NeutroRAN project which will lead to a test Open RAN in the UK in 2021. Meanwhile, in November 2020, the US Congress unanimously passed the Open RAN 5G Bill committing $750m to support the domestic 5G equipment market.

Our View

So, will the idea of open mobile network succeed? History shows there are no guarantees. For example, in 2010 the OpenStack initiative was announced to produce an open source cloud platform to meet the needs of public and private clouds. Good progress was made initially but over time commercial non-open cloud providers won out, especially in the form of Amazon’s AWS and Microsoft’s Azure.

Mobius’ view is the idea of open mobile networks has come too far and is too attractive to network operators and governments to fail. The single company that has done most to champion the idea is Rakuten and initial results appear promising. The main positives are reduced capital and operational costs along with the capability to respond more rapidly to customer requirements. Governments are also enthusiastic supporters and can be expected to accelerate the progress where they can.

On the face of it, the main losers could be the traditional telecom equipment manufacturers. Our view is the future for these companies is to shift from supplying proprietary hardware and software towards services, including cloud-based services, to network operators. This mirrors an earlier transition in the IT sector.

The final question is will the open network approach work in large scale networks? At the moment, most network operators adopting open networks are new entrants like Rakuten or operators deploying networks in low density rural areas. Some say that open RAN solutions have too many components and too much complexity to work in high density city networks where advanced features such as Massive MIMO are required.

There are also reservations about security. On the one hand open networks are seen as a solution to security concerns over monolithic networks provided by Huawei and other Chinese companies, but on the other hand their very openness could lead to its own security concerns.

One of the key drivers will be the recently completed 5G auction in the US where operators committed more than $80bn to secure spectrum for 5G. Operators will now rush to deploy their 5G networks and start recouping the cost of the spectrum. It is anticipated at least some of these operators will adopt the Open network approach, supported by government initiatives.

Our view is that, whilst Open RAN is more attractive initially to new entrant operators without legacy issues to consider, the impetus and the sheer volume of innovative companies now working in the area will quickly lead to many large scale operators adopting the technology. In the meantime, these operators need to gain experience with open networks through pilots and phased deployments. Operators should also consider whether to adopt a “packaged” approach, such as that offered by Rakuten with RCP, or go it alone.

To conclude, opening up mobile networks is an idea whose time has come, especially with the large scale adoption of 5G mobile technology.